India Smartwatch Market Size, Share, Trends and Forecast by Product, Operating System, Application, Distribution Channel, and Region, 2026-2034

India Smartwatch Market Summary:

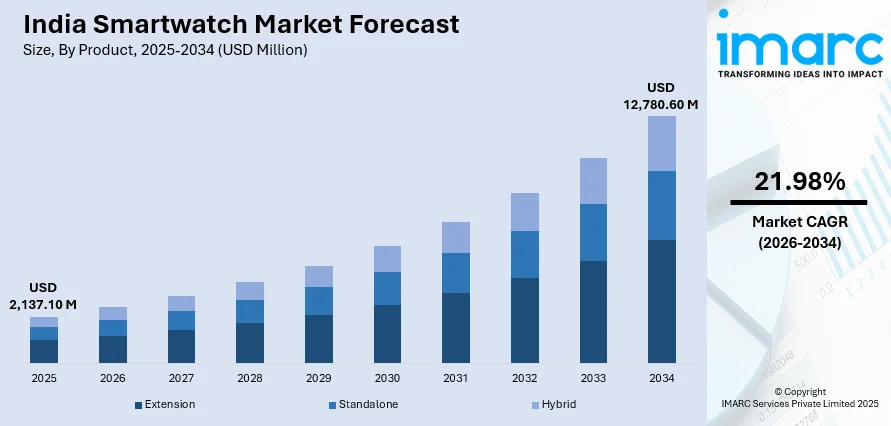

The India smartwatch market size was valued at USD 2,137.10 Million in 2025 and is projected to reach USD 12,780.60 Million by 2034, growing at a compound annual growth rate of 21.98% from 2026-2034.

The India smartwatch market is witnessing dynamic evolution driven by increasing health consciousness among consumers, rising smartphone penetration, and growing demand for wearable technology that integrates fitness tracking with connectivity features. The expanding middle-class population with rising disposable incomes, coupled with heightened awareness of personal wellness monitoring, is significantly contributing to the India smartwatch market share and driving adoption across diverse demographic segments.

Key Takeaways and Insights:

- By Product: Extension dominates the market with a share of 43.36% in 2025, driven by seamless smartphone integration capabilities and consumer preference for devices that complement existing mobile ecosystems.

- By Operating System: WatchOS leads the market with a share of 56.42% in 2025, attributed to strong brand loyalty, superior user experience, and deep integration with the broader device ecosystem.

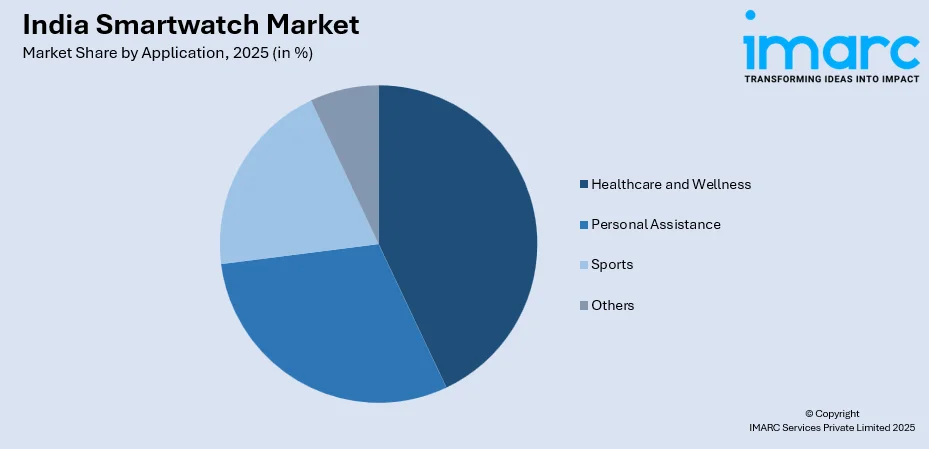

- By Application: Healthcare and wellness represent the largest segment with a market share of 42.95% in 2025, owing to growing consumer focus on fitness tracking, health monitoring, and preventive wellness management.

- By Distribution Channel: Offline stores dominates with a share of 70.04% in 2025, fueled by consumer preference for hands-on product experience, brand-authorized retail presence, and after-sales service accessibility.

- By Region: North India dominates with a market share of 31% in 2025, driven by high urbanization levels, concentration of tech-savvy consumers, and strong retail infrastructure in major metropolitan centers.

- Key Players: The India smartwatch market features a highly competitive landscape with global technology leaders competing alongside successful domestic brands. Key players differentiate through health monitoring capabilities, design aesthetics, ecosystem integration, and aggressive pricing strategies across market segments.

To get more information on this market Request Sample

The India smartwatch market has transformed from a niche technology segment to a mainstream consumer electronics category, driven by convergence of fashion, fitness, and connectivity functionalities. The market encompasses diverse product categories ranging from basic smartwatches offering essential fitness tracking to advanced devices featuring cellular connectivity, GPS navigation, and sophisticated health sensors. In Q1 2025, Indian brands dominated 91% of the smartwatch market, with premium ₹15,000+ models growing, highlighting feature-rich wearables and local leaders Noise and boAt. Consumer preferences are evolving toward devices that serve as comprehensive health companions, offering features such as heart rate monitoring, blood oxygen measurement, sleep analysis, and stress tracking. The ecosystem includes global technology giants with premium offerings alongside domestic brands that have successfully captured value-conscious segments through feature-rich products at competitive price points. Infrastructure developments in digital payments and the integration of smartwatches into broader digital lifestyle ecosystems are expanding use cases and driving market penetration.

India Smartwatch Market Trends:

Growing Focus on Advanced Health Monitoring Features

The India smartwatch market is witnessing intensified consumer demand for advanced health monitoring capabilities that extend beyond basic fitness tracking. Reflecting this shift, Huawei launched its Watch D2 in India in 2025 with built‑in medical‑grade blood pressure, ECG, heart rate, SpO₂, sleep, and stress monitoring features, underscoring how manufacturers are integrating clinical‑level health tools into wearables for Indian consumers. Devices incorporating medical-grade sensors for continuous heart rate monitoring, electrocardiogram readings, blood oxygen saturation measurement, and stress level assessment are gaining significant traction. Consumers increasingly view smartwatches as proactive health management tools that provide actionable insights into their physical wellbeing. This trend is particularly pronounced among health-conscious urban populations and individuals managing chronic conditions who benefit from continuous health data monitoring and early warning indicators.

Premiumization and Consumer Shift Toward Advanced Smartwatches

The market is experiencing a notable consumer shift from basic to advanced smartwatch categories as experienced users seek devices with enhanced functionality and superior build quality. In 2024, premium smartwatches priced above ₹20,000 saw supplies grow 147% as users upgraded for improved health tracking, smartphone integration, and connectivity, despite a 30% overall drop in shipments. Premium segments featuring improved health tracking accuracy, longer battery life, cellular connectivity, and refined design aesthetics are witnessing accelerated growth despite overall market consolidation. Consumers are demonstrating willingness to invest in higher-priced devices that deliver meaningful feature differentiation and reliable long-term performance. This premiumization trend is reshaping competitive dynamics as brands focus on value creation rather than volume-driven strategies.

Integration of Artificial Intelligence and Smart Features

Artificial intelligence integration is emerging as a key differentiator in the India smartwatch market, enabling personalized health insights, predictive analytics, and intelligent automation features. AI-powered algorithms analyze user health data patterns to provide customized fitness recommendations, sleep optimization suggestions, and wellness guidance. Voice assistants and natural language processing capabilities are enhancing user interaction experiences, enabling hands-free device control and information access. The integration of machine learning is improving accuracy of health metrics and enabling features such as automatic workout detection and adaptive notification management.

Market Outlook 2026-2034:

The India smartwatch market outlook remains favorable over the forecast period, driven by increasing digital adoption, rising health awareness, and continued innovation in wearable technology. The market is expected to benefit from growing integration of smartwatches into healthcare ecosystems, including insurance wellness programs and telemedicine platforms. Expansion into tier-II and tier-III cities presents significant growth opportunities as smartphone penetration increases and consumer awareness of smartwatch benefits expands beyond metropolitan markets. Technological advancements in battery efficiency, display technology, and sensor accuracy will enhance product capabilities and user experiences. The emergence of new form factors including smart rings and hybrid devices will diversify the wearable ecosystem and cater to varying consumer preferences. The market generated a revenue of USD 2,137.10 Million in 2025 and is projected to reach a revenue of USD 12,780.60 Million by 2034, growing at a compound annual growth rate of 21.98% from 2026-2034.

India Smartwatch Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Extension | 43.36% |

| Operating System | WatchOS | 56.42% |

| Application | Healthcare and Wellness | 42.95% |

| Distribution Channel | Offline | 70.04% |

| Region | North India | 31% |

Product Insights:

- Extension

- Standalone

- Hybrid

The extension dominates with a market share of 43.36% of the total India smartwatch market in 2025.

Extension smartwatches have established market leadership by offering seamless connectivity with paired smartphones, enabling users to access notifications, manage calls, and control applications directly from their wrist. Despite an overall contraction in India’s smartwatch shipments, brands that emphasize strong smartphone integration-maintained relevance, with Noise and Boat continuing to command notable smartwatch shares even as overall wearable volumes declined in mid-2025 according to IDC data. These devices serve as convenient extensions of smartphone functionality, appealing to consumers who prioritize connectivity and convenience in their wearable devices. The segment benefits from the high smartphone penetration in India and consumer preference for integrated digital ecosystems that enhance productivity and accessibility.

The extension segment's dominance reflects consumer appreciation for devices that complement rather than replace smartphones, offering additional functionality without requiring separate cellular connectivity. Manufacturers have optimized these devices for efficient battery management and smooth synchronization with mobile applications. The segment continues evolving with improved notification handling, enhanced app ecosystems, and refined user interfaces that streamline interaction between smartwatch and smartphone.

Operating System Insights:

- WatchOS

- Android

- Others

The WatchOS leads with a share of 56.42% of the total India smartwatch market in 2025.

WatchOS has established dominance in the India smartwatch market through its refined user experience, comprehensive health tracking capabilities, and seamless integration with the broader device ecosystem. In 2024, Apple Watch shipments in India grew by 141% even as overall smartwatch volumes declined, driven in large part by strong demand for WatchOS-powered premium devices that offer tight smartphone and health ecosystem integration. The operating system offers consistent performance, regular software updates, and access to a curated application library that enhances device functionality. Premium positioning and strong brand loyalty among users who value quality, reliability, and ecosystem coherence contribute to the segment's market leadership.

The WatchOS platform benefits from advanced health and fitness features including sophisticated workout tracking, fall detection, and emergency communication capabilities that differentiate it from competing operating systems. Continuous innovation in health monitoring, including advanced cardiac analysis and wellness metrics, reinforces the platform's appeal among health-conscious consumers. The segment's growth is supported by expanding retail presence and service networks that ensure premium customer experience throughout the ownership lifecycle.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Personal Assistance

- Healthcare and Wellness

- Sports

- Others

The healthcare and wellness dominate with a market share of 42.95% of the total India smartwatch market in 2025.

Healthcare and wellness applications have become the primary driver of smartwatch adoption in India, reflecting heightened consumer awareness of personal health monitoring and preventive wellness management. India ranks among the top three global markets for health tracker and wearable adoption, with about 32% penetration, highlighting growing use of smartwatches in everyday health management. Smartwatches offering continuous health tracking features including heart rate monitoring, sleep analysis, stress measurement, and activity tracking resonate strongly with health-conscious consumers seeking data-driven insights into their physical wellbeing. The segment benefits from growing lifestyle disease prevalence that motivates proactive health management approaches.

The healthcare and wellness segment's growth is further supported by increasing integration of smartwatch data with broader health management ecosystems, including fitness applications, telemedicine platforms, and wellness programs. Consumers appreciate the ability to track health metrics over time, identify patterns, and receive personalized recommendations for improving wellness outcomes. Advanced features such as irregular heart rhythm notifications and blood oxygen monitoring are expanding the segment's relevance for both preventive wellness and health condition management.

Distribution Channel Insights:

- Online Stores

- Offline Stores

The offline stores leads with a share of 70.04% of the total India smartwatch market in 2025.

Offline retail channels maintain significant leadership in smartwatch distribution, reflecting consumer preference for hands-on product experience before making purchase decisions involving wearable technology. Physical retail environments enable consumers to evaluate design aesthetics, try on different models for fit and comfort, and interact with device interfaces directly. Brand-authorized showrooms, multi-brand electronics retailers, and premium lifestyle stores offer personalized consultation and product demonstration services that enhance purchase confidence.

The offline channel's dominance is reinforced by after-sales service accessibility, warranty support, and the ability to address customer queries in person. Retailers have enhanced in-store experiences through dedicated smartwatch display zones, trained staff, and interactive demonstration units that showcase device capabilities. The channel also benefits from impulse purchase opportunities, bundling with smartphones and accessories, and promotional activities during festive seasons that drive consumer foot traffic and conversions.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

North India exhibits a clear dominance with a 31% share of the total India smartwatch market in 2025.

North India's market leadership reflects high urbanization levels, concentration of tech-savvy consumer populations, and strong presence of organized retail infrastructure in major metropolitan centers including the National Capital Region. The region benefits from high disposable incomes among urban professionals and youth demographics who are early adopters of wearable technology. Strong brand presence through exclusive showrooms, multi-brand outlets, and e-commerce fulfillment networks ensures product accessibility across diverse consumer segments.

The region's smartwatch adoption is driven by lifestyle aspirations, health consciousness among urban populations, and the influence of fitness culture in metropolitan areas. Corporate gifting trends and workplace wellness programs contribute additional demand from enterprise segments. The extension of distribution networks into tier-II cities within the region is expanding market reach and driving volume growth as smartwatch awareness increases beyond primary metropolitan markets.

Market Dynamics:

Growth Drivers:

Why is the India Smartwatch Market Growing?

Rising Health Awareness and Preventive Wellness Focus

Growing health consciousness among Indian consumers is driving significant demand for smartwatches that enable continuous health monitoring and wellness tracking. According to a 2025 PwC report, over 80% of Indian consumers use at least one healthcare app or wearable, including smartwatches, to track exercise, sleep, diet, and overall wellbeing. Increasing awareness of lifestyle diseases, stress-related health issues, and the importance of regular physical activity motivates consumers to invest in devices that provide actionable health insights. The ability to monitor vital parameters including heart rate, sleep quality, and activity levels empowers users to make informed decisions about their wellbeing. This health-focused consumer behavior is particularly prevalent among urban professionals and fitness enthusiasts who view smartwatches as essential health management companions.

Expanding Smartphone Ecosystem and Digital Lifestyle Integration

The high smartphone penetration in India creates a natural foundation for smartwatch adoption as consumers seek devices that extend and enhance their mobile experience. The India smartphone market size reached 153.3 million units in 2024 and is expected to expand to 277.1 million units by 2033, reflecting the growing base of connected consumers who form the primary target audience for smartwatch adoption. Seamless connectivity between smartphones and smartwatches enables convenient access to notifications, communication features, and productivity applications directly from the wrist. The integration of smartwatches into broader digital ecosystems including payments, music streaming, and navigation services expands utility beyond basic timekeeping and fitness functions. This ecosystem connectivity appeals to digitally engaged consumers who value the convenience of wearable technology in their daily routines.

Competitive Pricing and Feature-Rich Affordable Options

The availability of feature-rich smartwatches at competitive price points has democratized access to wearable technology across diverse consumer segments in India. Domestic brands have successfully introduced affordable devices incorporating health tracking, notification management, and calling features that previously were available only in premium categories. Aggressive pricing strategies, combined with promotional discounts during festive periods and e-commerce sales events, have lowered barriers to entry for first-time smartwatch buyers. This affordability-driven adoption is particularly strong among younger consumers and value-conscious buyers seeking technology upgrades within budget constraints.

Market Restraints:

What Challenges the India Smartwatch Market is Facing?

Limited Product Differentiation and Innovation Gaps

The market faces challenges from limited meaningful differentiation among products, particularly in the value segment where many devices offer similar feature sets and specifications. Consumers report disappointment with upgrade cycles that fail to deliver substantial improvements over previous generations. The reliance on similar original design manufacturers results in homogeneous product offerings that struggle to command premium positioning or justify replacement purchases.

Accuracy and Reliability Concerns with Budget Devices

Consumer confidence in budget smartwatch segments is challenged by concerns regarding health tracking accuracy and device reliability. First-time buyers who experience inconsistent sensor readings or premature device failures develop skepticism toward the product category, affecting repeat purchase intentions and word-of-mouth recommendations. These quality concerns particularly impact domestic brands competing in price-sensitive segments.

Battery Life Limitations and Charging Inconvenience

Limited battery life requiring frequent charging remains a significant adoption barrier for consumers accustomed to traditional watches that require no daily maintenance. The inconvenience of regular charging routines, particularly for devices with advanced features that consume additional power, discourages some potential buyers. Consumers express preference for extended battery duration over additional features, creating tension with manufacturer strategies focused on feature expansion.

Competitive Landscape:

The India smartwatch market features an intensely competitive landscape characterized by global technology leaders commanding premium segments alongside successful domestic brands dominating value and mid-range categories. Market leaders differentiate through ecosystem integration, health monitoring capabilities, and brand positioning while domestic players compete through aggressive pricing, feature parity, and extensive distribution networks. The competitive environment is evolving as brands shift focus from volume-driven strategies toward premiumization and sustainable profitability. Strategic initiatives encompass product innovation in health monitoring, retail expansion into offline channels, and diversification into adjacent wearable categories including smart rings. Partnerships with technology platforms, healthcare providers, and fitness applications are strengthening ecosystem positioning and expanding use cases.

Recent Developments:

- In September 2025, Fastrack launched its AI‑powered MYND smartwatch in India, targeting tech-savvy youth. The device offers personalized reminders, adaptive watch faces, and comprehensive health and fitness tracking. Designed to blend style with smart functionality, MYND aims to provide an intelligent, user-centric wearable experience.

India Smartwatch Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Extension, Standalone, Hybrid |

| Operating Systems Covered | WatchOS, Android, Others |

| Applications Covered | Personal Assistance, Healthcare and Wellness, Sports, Others |

| Distribution Channels Covered | Online Stores, Offline Stores |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India smartwatch market size was valued at USD 2,137.10 Million in 2025.

The India smartwatch market is expected to grow at a compound annual growth rate of 21.98% from 2026-2034 to reach USD 12,780.60 Million by 2034.

Extension smartwatches dominate the India smartwatch market with a 43.36% share, driven by seamless smartphone integration capabilities and consumer preference for devices that complement existing mobile ecosystems.

Key factors driving the India smartwatch market include rising health awareness and preventive wellness focus, expanding smartphone ecosystem integration, and the availability of competitive pricing with feature-rich affordable options.

Major challenges include limited product differentiation and innovation gaps, accuracy and reliability concerns with budget devices, and battery life limitations requiring frequent charging that affects consumer adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)